kern county property tax rate 2021

Tax bills were mailed to all property owners whose addresses were on file with the County Assessor as of Jan. Change a Mailing Address.

Mortgage Interest Rates Today Texaslending Com Mortgage Interest Rates Mortgage Interest Mortgage Rates

For questions about filing extensions tax relief and more call.

. You Can See Data Regarding Taxes Mortgages Liens Much More. File an Assessment Appeal. - A PROPERTY OWNER CANNOT BUY THEIR OWN PROPERTY AT A TAX SALE FOR LESS THAN THE TAXES.

This is the total of state and county sales tax rates. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. ASSESSOR 1115 Truxtun Avenue Bakersfield CA 93301 8-5 M-F Except Holidays.

KGET The Kern County Assessors Office announces the completion of the 2020-2021 assessment roll. Suggested annual investment guidelines are based on the number of employees OR the amount of Kern County property taxes paid whichever is higher. Dec 8 2021.

Table I is the state property tax rate. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. According to a press release these bills represent taxes levied by Kern County schools and other taxing agencies within Kern County and provide revenue for their operating funds.

Kern County collects relatively high property taxes and is ranked in the top half of all counties in the United. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of 080 of property value. If you own property in Kern County and did not receive your tax bills contact the County Treasurer-Tax Collectors Office via email at TTC.

Kern County real property taxes are due by 5 pm. KGET The Kern County Assessors Office announces the completion of the 2020-2021 assessment roll. Stay Connected with Kern County.

Treasurer-Tax Collector mails delinquent notices for any unpaid regular current taxes. Request a Value Review. Kern County real property taxes are due by 5 pm.

Bedard cpa auditor-controller-county clerk. Kern County Assessor-Recorder County Terms of Sale - March 2022 Kern County General Tax Sale Information Kern County Tax Sale Brochure List of Title Companies Tax Rate Areas Zoning Departments Zoning Information News and Announcements. County of kern tax rates and assessed valuations 2020-2021 compiled by the office of mary b.

The California state sales tax rate is currently. 1115 Truxtun Avenue Bakersfield CA 93301-4639. To review the rules in California visit our.

I hope you find this website informative and helpful and that you return regularly to see what is happening in our office. Delinquent accounts are transferred to delinquent tax roll and additional penalties added at 1- 12 per month on any unpaid tax amounts plus 1500 redemption fee. Kern County collects on average 08 of a propertys assessed fair market value as property tax.

Appropriate notice of any levy increase is another requisite. The Kern County sales tax rate is. 2019-2020 Annual Property Tax Rate Book.

Find Property Assessment Data Maps. Ad Get a Vast Amount of Property Information Simply by Entering an Address. Taxation of real property must.

Payments can be made on this website or mailed to our payment processing center at PO. Has impacted many state nexus laws and sales tax collection requirements. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

The Treasurer-Tax Collector collects all property taxes. Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes. Tax Rate Areas Kern County 2021.

Online videos and Live Webinars are available in lieu of in-person classes. The Table III provides the basic rate table showing on a county basis all EXPLANATION OF RATE TABLES This publication reports the 2021 ad valorem property tax rates of the state and Kentucky has a broadly-based classified property tax system. Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes.

Tax rate set by County Sanitary and Sanitation Districts. Businesses impacted by the pandemic please visit our COVID-19 page Versión en. Please type the text from the image.

Purchase a Birth Death or Marriage Certificate. Please access our website for additional information. California has a 6 sales tax and Kern County collects an additional 025 so the minimum sales tax rate in Kern County is 625 not including any city or special district taxes.

The total assessed value of all taxable property in the county as of January 1 2020 is valued 1022 billion a 28 billion increase over the prior year said the Assessors Office. Taxpayers may inquire or make payments on their property taxes in person by mail or via the Internet. Find Property Assessment Data Maps.

Within those confines the city sets tax rates. Start filing your tax return now. File an Assessment Appeal.

Find Property Assessment Data Maps. California Mortgage Relief Program Property Tax Assistance. Oct 6 2021.

If you do not have your tax bill you may request a substitute tax bill or you may obtain the amount of property tax due by calling 661-868-3490 or by emailing ttc. Auditor - Controller - County Clerk. Kern County Taxpayers Association 82nd Annual Meeting November 24 2021.

Ad Unsure Of The Value Of Your Property. The Kern County Sales Tax is collected by the merchant on all qualifying sales made within. The Assessors Office said major properties.

Please contact the local office nearest you. A 10 penalty plus 1000 cost is added as of 500 pm. Get Information on Supplemental Assessments.

KernTax 82nd Annual Meeting Video Discussion December 8 2021. 1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted. Search for Recorded Documents or Maps.

2020-2021 Annual Property Tax Rate Book. Tax Rate Areas Kern County 2021. November 29 2021 59 min.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Box 541004 Los Angeles CA 90054-1004. The first round of property taxes is due by 5 pm.

800 AM - 500 PM Mon-Fri 661-868-3599. That equates to about an 119 million increase in property tax revenue to the county which had been estimated at around 280 million for fiscal year 2021-22 allowing officials to address a. File an Exemption or Exclusion.

The Kern County California sales tax is 725 the same as the California state sales tax. Table II provides the average tax rates for Kentucky for 2021. Tax Rate Areas Kern County 2021.

Information in all areas for Property Taxes. The 2018 United States Supreme Court decision in South Dakota v.

Brazos County Leaders Adopt New Tax Rate Discuss Merit Pay

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

El Paso City Council Approves New District Boundaries Effort To Reduce Tax Rate El Paso Matters

Robert Price Increase The Kern County Sales Tax By A Penny Robert Price Bakersfield Com

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Transfer California Property Tax Base From Old Home To New

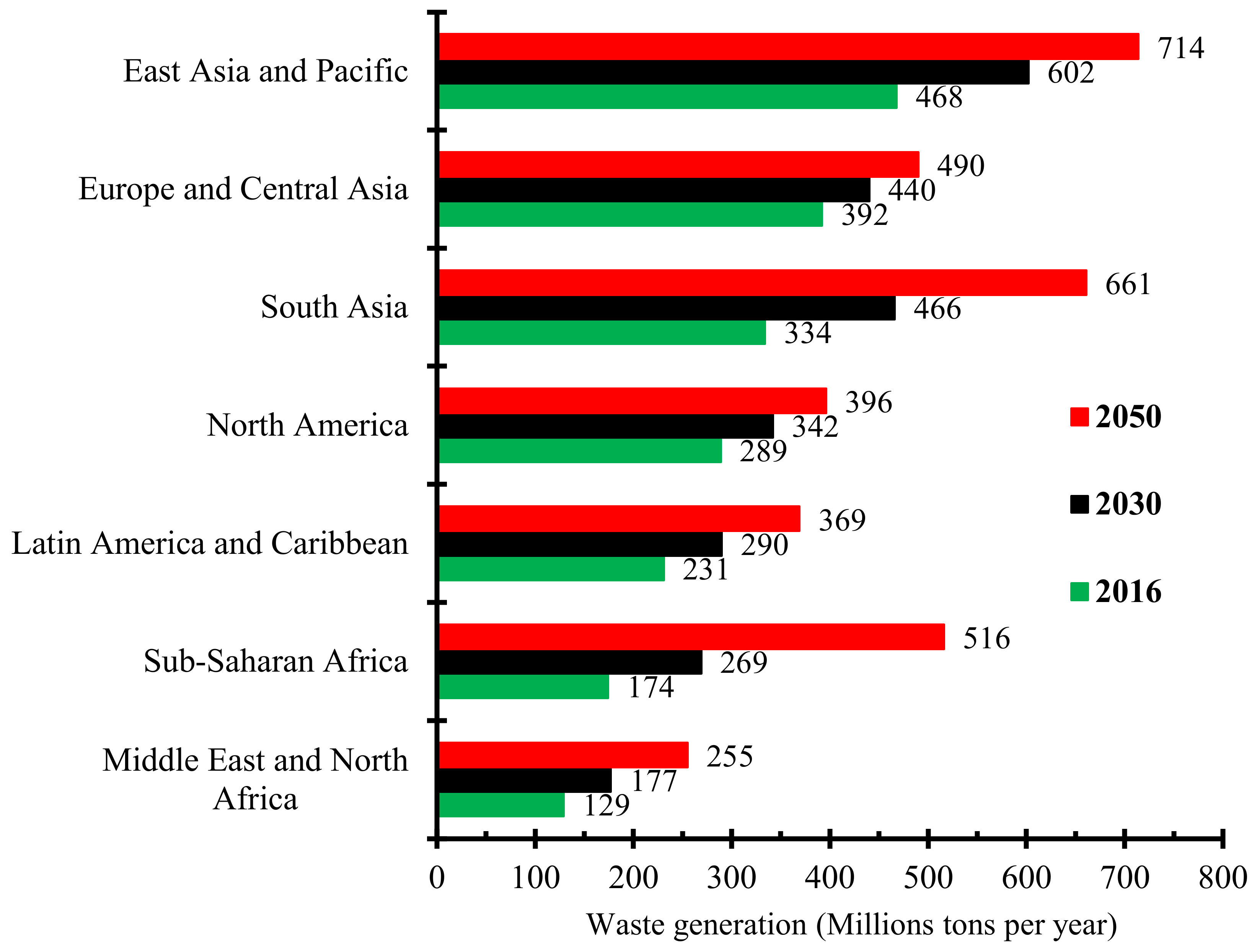

Sustainability Free Full Text Resource Recycling With The Aim Of Achieving Zero Waste Manufacturing Html

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

San Francisco County Ca Property Tax Search And Records Propertyshark

/what-difference-between-state-and-federally-chartered-credit-union_final-6d23ae652fc34b3d96a7ce26e31b4543.png)

State Vs Federally Chartered Credit Unions

San Diego Property Taxes In California Prop 15

Riverside County Ca Property Tax Calculator Smartasset

Appraiser Explains How To Protest Higher Home Values And Property Taxes Kiiitv Com

Kern County Property Tax Payments Due December 10th

Property Tax California H R Block

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

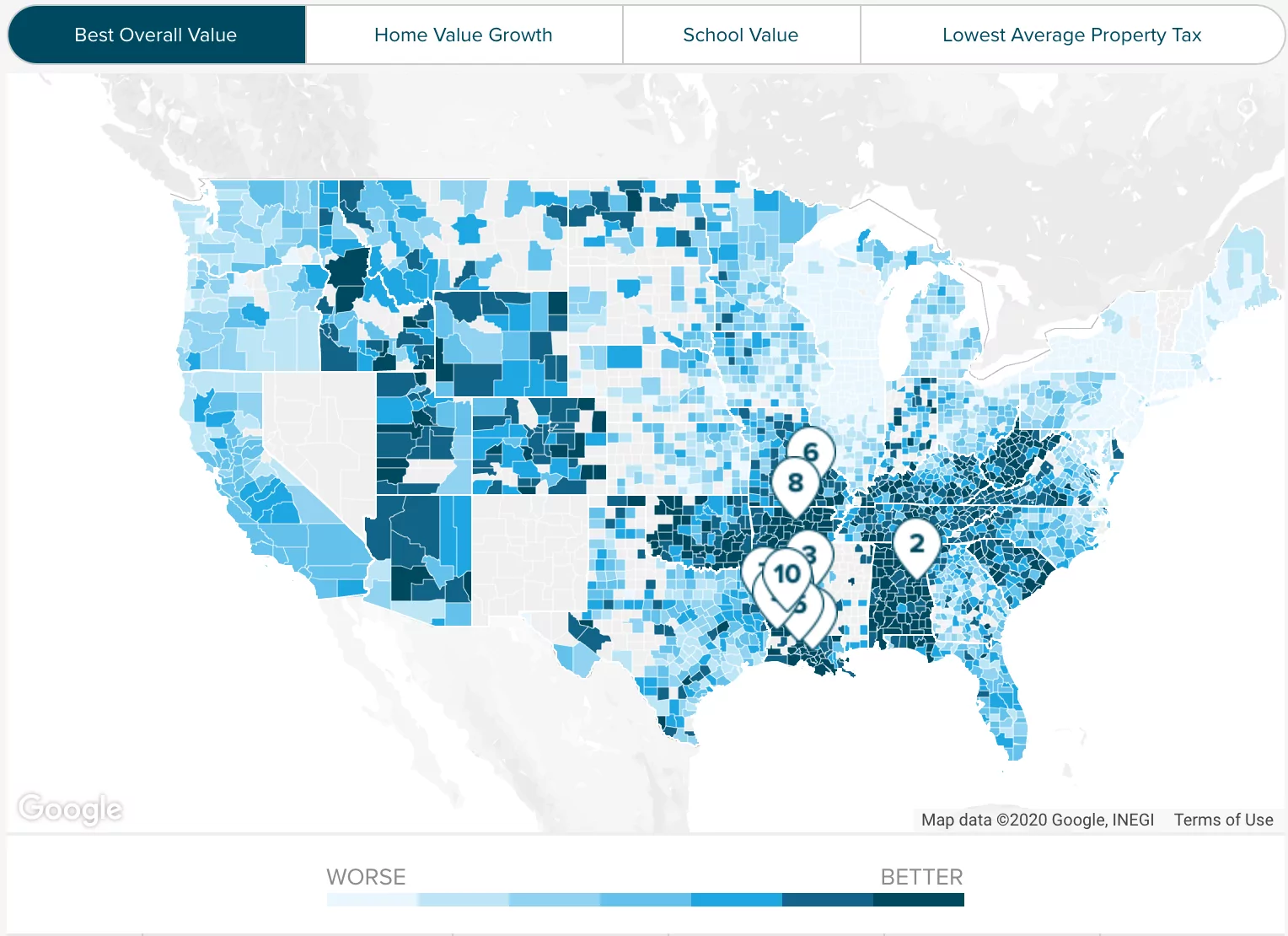

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa